Welcome to CAPlus, your trusted partner for comprehensive tax, compliance, and business registration services in Patna, Bihar. With a team of seasoned experts, we simplify the legal and financial complexities of starting, running, and managing a business, making your entrepreneurial journey smooth and stress-free.

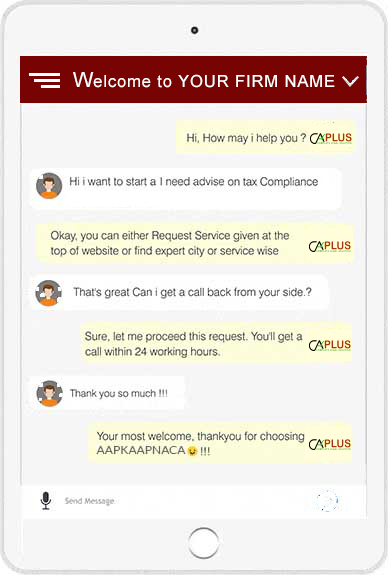

Talk to Experts Instantly at India’s Most Trusted Tax, Compliance & Investment Platform

Our Awesome Services

A private limited company is a flexible business structure with 2 to 200 members and no limits on

paid-up share

capital.

Filing income tax returns is a yearly responsibility, with deadlines varying based on the type of

taxpayer.

Trademark registration protects your brand by giving you the legal tools to prevent others from using it without permission or infringing on your rights.

A strong advisory team can transform the course of your business, guiding it toward greater success with their expert insights and strategic advice.

Let our experts streamline your workflow and implement cutting-edge technology. Trusted IT consulting and managed services, tailored for your success.

The quality of your products and services is what matters most to your customers.

Find Tax/Compliance Expert - Tax Consultants

Convenience

Having serve the clients since 2016, We understand your needs therefore we will give you the best experience throughout.

Support

For both the service providers & service receivers, We are always available to you through Chat, Email, Call or social media.

Experience

This is our first priority as it means everything that any user want to have while using online service facility.

Safety

Poor safety will lead to losing people, we very well understand this fact. Should there be NDA? Anytime!

Our Testimonials

ISSUES ARE ALWAYS RESOLVED BY THEM.YOU CAN COMPLETELY RELY ON THEM FOR ALL YOUR TAXATION QUERIES AND THEY WILL GUIDE you.

Md Islam

CAPlus is a good pletaphorm for company registration, tax filing, Managament of caplus is well managed and well experianced too.

Tannu Priya

We are fully satisfied with CAPlus services. They are a well-experienced, knowledgeable, and professional team. Well Done CAPlus team.

Nilesh Mishra

We are fully satisfied with CAPlus services. They are a well-experienced, knowledgeable, and professional team. Well Done CAPlus team.

Muskan

Related Video