The law relating to partnership firm in India is prescribed in the Indian Partnership Act of

1932. This Act lays down the rights and duties of the partners between themselves and other

legal relations between partners and third persons, which are incidental to the formation of a

partnership. Thus, the Act establishes the position of a partner as well as a partnership firm

vis-à-vis third parties, in legal and contractual relations arising out of and in the course of

the business of a partnership firm. In this article, we look at the various aspects of running a

partnership firm in India in detail.

A partnership is a relationship between

individuals who have agreed to share the profits of a business carried on by all or any one of

them acting for all as stated in Section 4 of the Indian Partnership Act. Therefore, a

partnership consists of three essential elements.

A partnership must be a result of an agreement between two or more individuals.

The agreement must be built to share the profits obtained from the business.

The business must be run by all or any of them representing the rest.

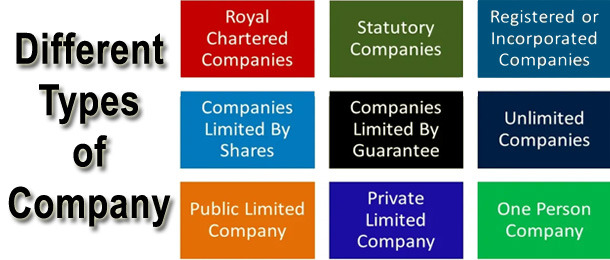

There are various types of entities recognized under the Indian Law

Private Limited Company:

Public Company,

Sole Proprietorship

One Person Company, Partnership

Limited Liability Partnership (LLP)

Non Government Organization (NGO)

Limited Company

Section-8 Company

Nidhi Company

Producer Company

The following are the major advantages of incorporating a private limited company in India versus other entity types.

Better credibility: Despite the fact that the Partnership act renders both a registered and unregistered firm legal, it is a, sure enough, case that a registered partnership firm looks more credible in the eyes of a potential client.

Ability to convert into an entity: A registered partnership firm always has the ease of converting itself to another corporate entity like that of a Limited Liability Partnership (LLP) or a private company.

Potential to sue the firm or sue the other partners: If any conflict should arise between the partners or between the current and previous partners or even between one of the partners and the firm itself.

Uninterrupted Existence: A company has 'perpetual succession,' which means it will continue to exist until it is legally dissolved.

An Agreement

Sharing Profit of Business

Running the Business

Proper and eligible Name (Name Approval Guidelines)

Registered Office Address & NOC from Owner

Requirement of Capital (Authorized Capital Vs Paid-up Capital)

Documentation for company registration.

The following are the steps involved in registering a company in India:

RUN Name Approval

Digital Signature for Directors

Incorporation Application Submission

Description of the goods or services

| Passport / Driver’s License / Election ID / Ration Card / Aadhaar ID |

| PAN Card |

| Address proof of the company |

| Rental Agreement |

| Bank Statement / Electricity Bill / Phone Bill |

| NOC from landlord |

1. How to Register a Company in India?

Digital Signature Certificate (DSC) Step 2: Director Identification Number (DIN) Step 3: Registration on the MCA Portal. Step 4: Certificate of Incorporation.

2. Are two directors necessary for registration of company?

Yes, a minimum of two directors are needed for a private limited company. The maximum members can be 200. You can register as a one person company, if you are the sole owner of the company.

3. Is it necessary to have a company’s books audited?

Yes, a private limited company must hire an auditor, no matter what its revenues. In fact, an auditor must be appointed within 30 days of incorporation. Compliance is important with a private limited company, given that penalties for non-compliance can run into lakhs of rupees and even lead to the blacklisting of directors.

4. What is the minimum capital needed to do company incorporation?

There is no minimum capital required for starting a private limited company.

5. Does one have to be present in person for Company Incorporation?

The entire procedure is done online and one does not have to be present at our office or any other place for the incorporation. A scanned copy of the documents has to be sent via mail. They get the company incorporation certificate from the MCA via courier at the business address.