A Private Limited Company (PLC) is one of the most common types of legal entity in India. Private Limited Companies are governed by the Companies Act, 2013 and require a minimum of 2 Directors and 2 Shareholders with one of the Directors being an Indian Resident and Indian Citizen.

To register a company in india, the following are minimum requirements:

2 Directors – 1 Person should be an Indian National and Indian Resident

2 Shareholders – The Directors can be shareholders

Registered Office in India

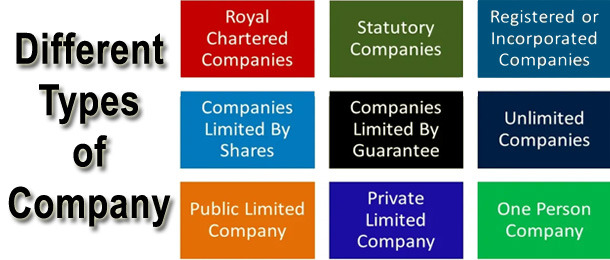

There are various types of entities recognized under the Indian Law

Private Limited Company:

Public Company,

Sole Proprietorship

One Person Company, Partnership

Limited Liability Partnership (LLP)

Non Government Organization (NGO)

Limited Company

Section-8 Company

Nidhi Company

Producer Company

The following are the major advantages of incorporating a private limited company in India versus other entity types.

Separate Legal Entity: A company is both a legal entity and a juristic person. Therefore, a company has broad legal rights to like acquiring property, incurring debts, hiring people, etc.

Limited Liability: A private limited company is a separate legal entity with limited liability provisions. Therefore, the shareholders are not liable for the losses of the company – for an amount more than what was invested by them into the company as share capital. .

Fund Raising: A private limited company has multiple options for fundraising. A company can raise funds from shareholders, investors, angels, venture capital funds, private equity funds, foreign funds, NBFCs, banks and other financial institutions. Only a company can raise debt and equity funds from investors.

Uninterrupted Existence: A company has 'perpetual succession,' which means it will continue to exist until it is legally dissolved. Because a company is a separate legal entity, it is unaffected by the death or other departure of any of its members, and it continues to exist regardless of membership changes.

The proposed directors of a private limited company must present the following documents as proof of identification in order to register a company:

Auditor Appointment: All companies registered in India must appoint a practicing and licensed Chartered Accountant registered with the ICAI within 30 days of incorporation.

Director DIN KYC: All persons who hold a Director Identification Number (DIN) – which is allocated during the incorporation process must complete DIN KYC each year to validate the phone and email address on record with the Ministry of Corporate Affairs.

Commencement of Business: Within 180 days of incorporation, the company must open a Bank Current Account and the shareholders must deposit the subscription amount mentioned in the MOA of the company. Hence, if the company was to be incorporated with a paid-up capital of Rs. 1 lakh, then the shareholders must deposit Rs. 1 lakh in the Company’s bank account and file the bank statement with the MCA to obtain a commencement of business certificate.

MCA Annual Filings: All companies registered in India must file a copy of the financial statements with the Ministry of Corporate Affairs each financial year. If a company is incorporated between January – March, the company can choose to file the first MCA annual return as a part of the next financial year’s annual filing. MCA annual return consists of Form MGT-7 and Form AOC-4. Both these forms must be digitally signed by the Directors and a practising professional.

Income Tax Filing: All companies must file an income tax return using Form ITR-6 each financial year. Income tax filing must be done for each financial year before the due date – irrespective of the incorporation date. The income tax return of a company must be digitally signed using one of the Director’s digital signature.

Number of Shareholders of Company

Number of Directors (Composition of Board of Directors)

The requirement of an Indian Resident Director

Proper and eligible Name (Name Approval Guidelines)

Registered Office Address & NOC from Owner

Requirement of Capital (Authorized Capital Vs Paid-up Capital)

Documentation for company registration.

The following are the steps involved in registering a company in India:

RUN Name Approval (RUN - Reserved Unique Name)

Apply for DIN

Process of Incorporation

Preparing for MOA & AOA

Finally, we are getting COI (Certificate of Incorporation)

COI (Certificate of Incorporation)

MOA

AOA

PAN

TAN

Document required for Business Tax Filing

Document required for TDS Filing

Document required for GST Registration

Document required for GST Return Filing

Document required for Trademark Registration

Document required for company Registration

Document for private Limited Registration

Partnership company Registration

| KYC (Aadhaar, PAN, Voter ID, Email Id, Passport Size Photo, Signature, Mobile No.) |

| Utility Bill (Electricity Bill/Telephone Bill /GAS Bill) |

| Latest Bank Statement of all the Promoter/Subscriber/Members. |

| Rental Agreement with Business. |

| Others, if Any Required. |

1. How to Register a Company in India?

Digital Signature Certificate (DSC) Step 2: Director Identification Number (DIN) Step 3: Registration on the MCA Portal. Step 4: Certificate of Incorporation.

2. Are two directors necessary for registration of company?

Yes, a minimum of two directors are needed for a private limited company. The maximum members can be 200. You can register as a one person company, if you are the sole owner of the company.

3. Is it necessary to have a company’s books audited?

Yes, a private limited company must hire an auditor, no matter what its revenues. In fact, an auditor must be appointed within 30 days of incorporation. Compliance is important with a private limited company, given that penalties for non-compliance can run into lakhs of rupees and even lead to the blacklisting of directors.

4. What is the minimum capital needed to do company incorporation?

There is no minimum capital required for starting a private limited company.

5. Does one have to be present in person for Company Incorporation?

The entire procedure is done online and one does not have to be present at our office or any other place for the incorporation. A scanned copy of the documents has to be sent via mail. They get the company incorporation certificate from the MCA via courier at the business address.